unfiled tax returns statute of limitations

In certain conditions you may need to return somewhat further. Unfiled returns may get assigned a 140 code and if so this means eventually they will file the tax return for you.

Tax Debt Statute Of Limitations Cseds And How It Works Piedmont Tax Clinic

So 2007 taxes that came due on April 15 2008 are now beyond the statute and the IRS cant bring criminal action against you for unfiled tax returns 2007 and before.

. But be aware the instructions say you must HAND the return to the Collector of Internal Revenue. Then the IRS has six years. The Statute of Limitations for Unfiled Taxes.

This Article Contains Data About The IRS Statute Of Limitations On Unfiled Tax Returns. If they do not put the code on it usually nothing happens after that. What is the Unfiled Tax Returns Statute of Limitations.

Your refund expires and goes away forever if you wait longer than the deadline because the statute of limitations for claiming a refund will have closed. It is true that the IRS can only collect on tax debts that are 10 years or younger. If you havent filed your federal taxes in years you may be under the mistaken assumption that youre protected by a statute of limitationsthat is if the IRS doesnt notice your transgression within a certain period of time then theyre no longer entitled to their money.

Is there a statute of limitations on unfiled tax returns. So if you havent yet filed your 1913 income tax return you can still do so. The IRS will not be able to bring criminal charges after 6 years from the date the taxes are due.

For unfiled returns or cases involving tax fraud the assessment period is unlimited. Statutes of limitations place time limits on how long individuals can be held responsible for criminal offenses but there is no statute of limitations for failing to file tax returns. The Statute of Limitations for Unfiled Taxes.

The IRS Statute of Limitations on Action for Back Taxes relies upon a couple of variables. An original return claiming a refund must be filed within 3 years of its due date for a refund to be allowed in most instances. Many folks believe that the IRS cannot take action against them if 10 years have passed since they last filed a tax return.

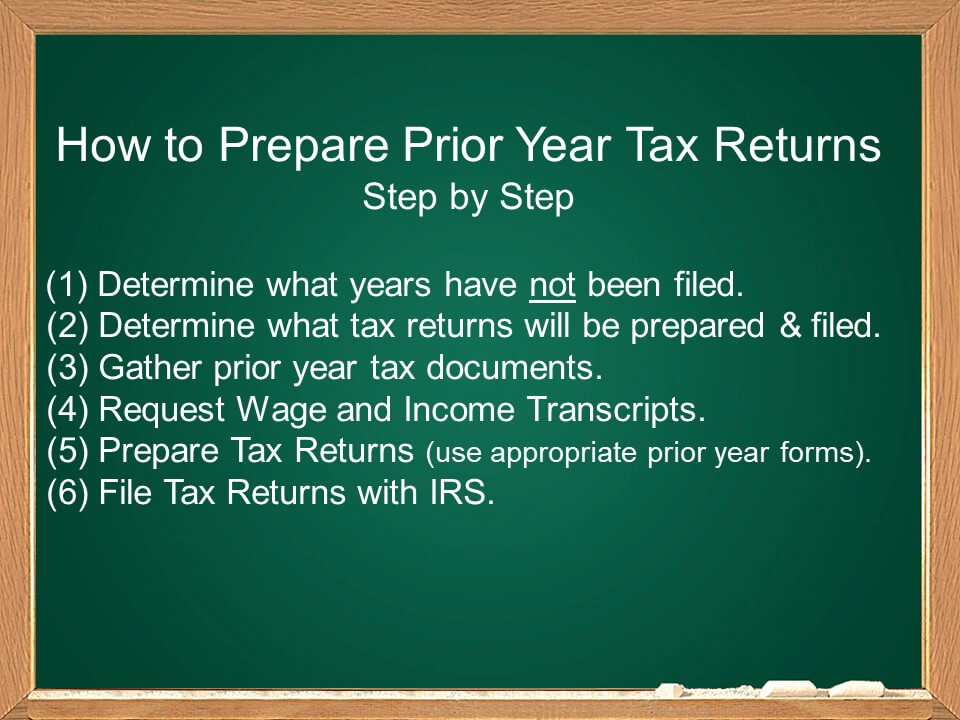

The IRS approach is that in the event that you do choose to get state-of-the-art and document old returns you just need to return and record for as far back as 6 years. The policy also states that IRS management would have. First it is important to note what exactly is meant by date of assessment which is April 15th of the year your taxes were due or the date your return was actually filed whichever date is later is when the clock begins ticking.

The essential factor is whether a Tax return was documented or not. In most cases the IRS requires you to go back and file your last six years of tax returns to get in their good graces. Once this statute of limitations has expired the IRS may no longer go after you for taxes that you owe.

However you risk losing a refund altogether if you file a return or otherwise claim a refund after the statute of limitations has expired. However state tax agencies may have longer. There is no statute of limitations on unfiled returns.

The IRS can go back to any unfiled year and assess a tax deficiency along with penalties. There isnt one but typically the IRS only goes back 6 years. When fake or unfiled returns are involved the IRS has an.

There is a statute of limitations for unfiled tax returns. The good news is that the IRS does not require you to go back 20 years or even 10 years on your unfiled tax returns. Imagine a scenario in which you complete my returns and discover I owe money.

What is the statute of limitations on late-filed returns. The statute of limitations for tax fraud or evasion is generally three years after the date your return was due or the date you filed your return. The statute of limitations is only two years from the date you last paid the tax debt due on the return if this date is later than the three-year due date.

However in practice the IRS rarely goes past the past six years for non-filing enforcement. The Internal Revenue Code IRC requires that the IRS assesses funds credits and collects taxes within specific time limits known as the statutes of limitations SOL. Only after a person or organization files their unpaid taxes does the agency once again have a time limit of 10 years to collect the money.

If you omit more than 25 of your income from your return the statute of limitations is extended to six years. IRS Statute Of Limitations On Unfiled Tax Returns. The IRS can go back to any unfiled year and assess a tax deficiency along with penalties.

If an amended income tax return showing an increase in tax is received within 60 days of the ASED of the original return the assessment of the tax on the amended income tax return is extended for 60 days from the day the amended return was received on all subtitle A Income taxes. IRS Policy Statement 5-133 Delinquent Returns Enforcement of Filing Requirements provides a general rule that taxpayers must file six years of back tax returns to be in good standing with the IRS. There is no statute of limitations on a late filed return.

A common belief that many taxpayers have is that the IRS cannot take any actions against them if 10 years or more have passed since they last filed a tax return. However in practice the IRS rarely goes past the past six years for non-filing enforcement. Six years is also the period given to audit FBAR compliance.

The IRS Statute of Limitations On Back Taxes for Unfiled Taxes. Thats one reason it may be beneficial to file a tax return even if you dont have a filing requirement. For example California can attempt to collect.

The IRS cannot bring charges against you after this time unless you have omitted more than 25 of your income. The statute of limitations permits a taxpayer to claim a refund for unfiled tax returns for three years after the original filing date. How the IRS determines when the statute of limitations starts and stops is highly misunderstood.

There is no statute of limitations on a late filed return. It is also important to note that the statute of limitations applies to the ability of the. If the taxpayer does not file within this timeframe the IRS will bar a taxpayer from receiving a refund check applying for any tax credits and even overpayments of taxes.

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes

How Long Should You Worry About Unfiled Tax Returns Gartzman Tax Law Firm P C The Gartzman Law Firm P C

Irs Audit Statute Of Limitations May Be Extended For Failure To Report Foreign Financial Activity

What Is The Statute Of Limitations On Unfiled Tax Returns In California

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Tax Returns Irs Tax Relief Houston

Unfiled Tax Returns Mendoza Company Inc

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Tax Returns Unfiled Taxes Top Tax Defenders

Understanding The Statutue Of Limitations Verni Tax Law

Can I Go To Jail For Unfiled Tax Returns Tax Resolution

Irs Can Audit Your Taxes Forever If You Miss A Key Form

Failing To File Fbar Statute Of Limitations Verni Tax Law

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

How Far Back Can The Irs Collect Unfiled Taxes

Unfiled Past Due Tax Returns Faqs Irs Mind

Things To Know About Unfiled Tax Returns Stop Bank Levy Tax Problem Resolution