vermont income tax brackets

The latest available tax rates are for 2020 and. Vermont Income Tax Calculator 2021.

Raising State Income Tax Rates At The Top A Sensible Way To Fund Key Investments Center On Budget And Policy Priorities

Vermont State Personal Income Tax Rates and Thresholds in 2022.

. Tax Bracket Tax Rate. Your average tax rate is 1198 and your marginal tax rate is. GB-1210 - 2022 Income Tax Withholding Instructions Tables and Charts.

Each marginal rate only applies to earnings within. If you make 70000 a year living in the region of Vermont USA you will be taxed 12902. The latest available tax rates are for.

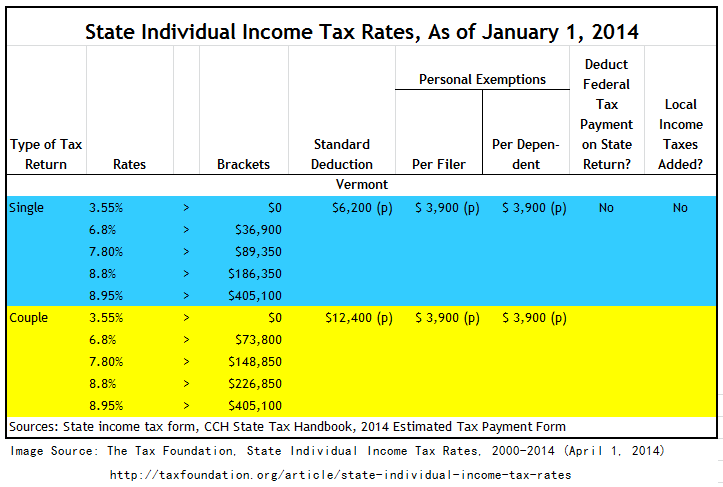

Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. VT or Vermont Income Tax Brackets by Tax Year. 2019 Income Tax Withholding Instructions Tables and Charts.

Vermonts income tax brackets were last changed one year prior to 2003 for tax year 2002 and the tax rates have not been changed since at least 2001. Personal income tax is collected from individuals or entities. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022.

Vermont has four marginal tax brackets ranging from 335 the lowest Vermont tax bracket to 875 the highest Vermont tax bracket. A list of Income Tax Brackets and Rates By Which You Income is Calculated. 2017 VT Rate Schedules.

Tax Rates and Charts. When you file your tax return annually on or before the April filing deadline you are reconciling the amount of taxes you have. Detailed Vermont state income tax rates and brackets are available on this page.

2018 VT Tax Tables. Local Option Alcoholic Beverage Tax. 2017-2018 Income Tax Withholding.

Vermont Income Taxes. Vermonts income tax brackets were last changed two. Vermont also has a 600 percent to 85 percent corporate income tax rate.

9 Vermont Meals Rooms Tax Schedule. Rates range from 335 to. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022.

Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets. 6 Vermont Sales Tax Schedule. Local Option Meals and Rooms.

2017 VT Tax Tables. Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of Vermont. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76.

The state income tax rate in Vermont is progressive and ranges from 335 to 875 while federal income tax rates range from 10 to 37 depending on your income. Vermonts income tax brackets were last changed one year prior to 2019 for tax year 2018 and the tax rates were previously changed in 2017. Detailed Vermont state income tax rates and brackets are available on this page.

Any sales tax that is collected belongs to the state and does. Vermont Income Tax Rate 2020 - 2021. Here you can find how your Vermont based income is taxed at different rates within the given tax brackets.

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020.

Service Tax Study Prompts Alarm The White River Valley Herald

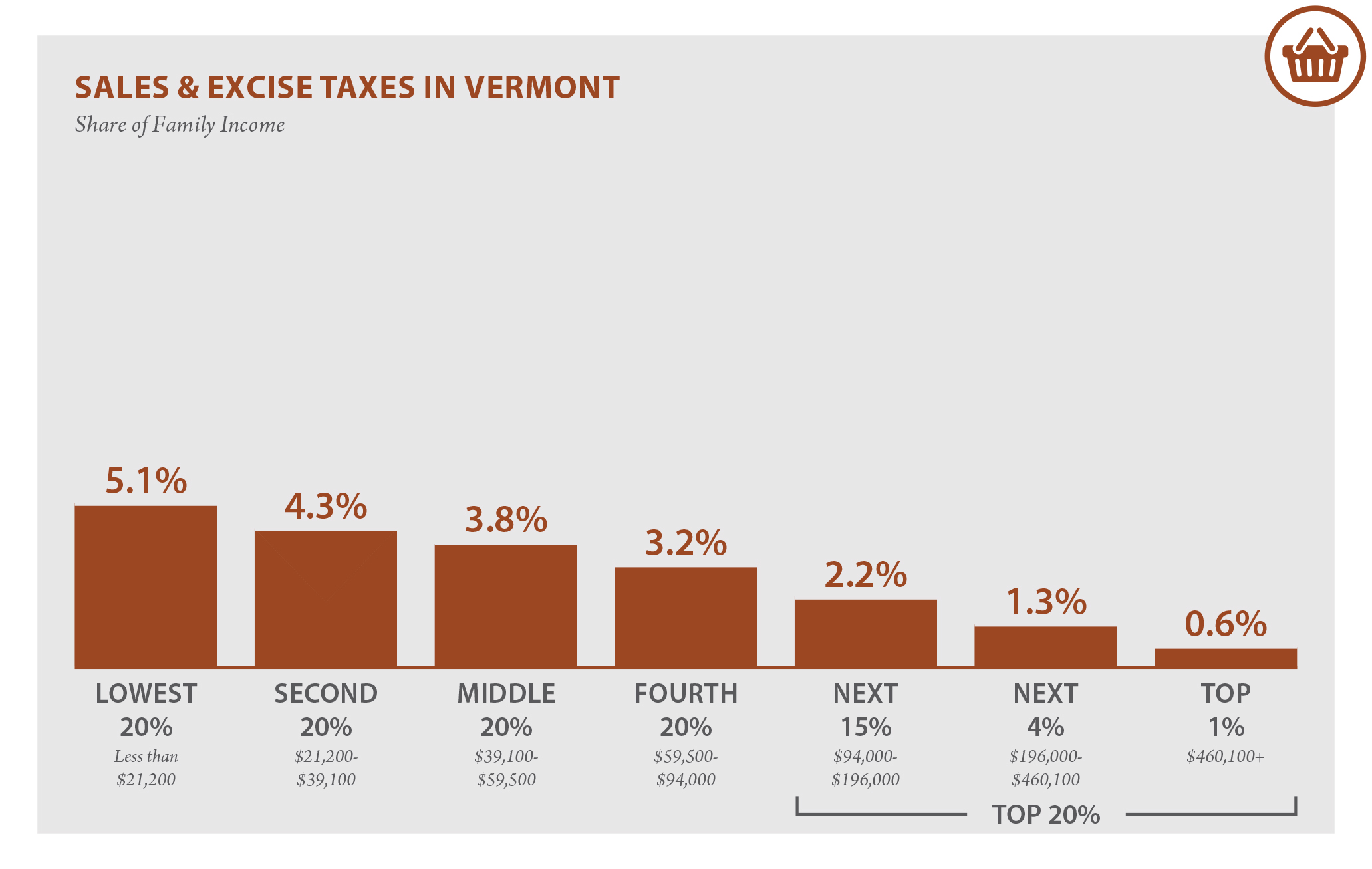

Vermont Who Pays 6th Edition Itep

Top States For Business 2022 Vermont

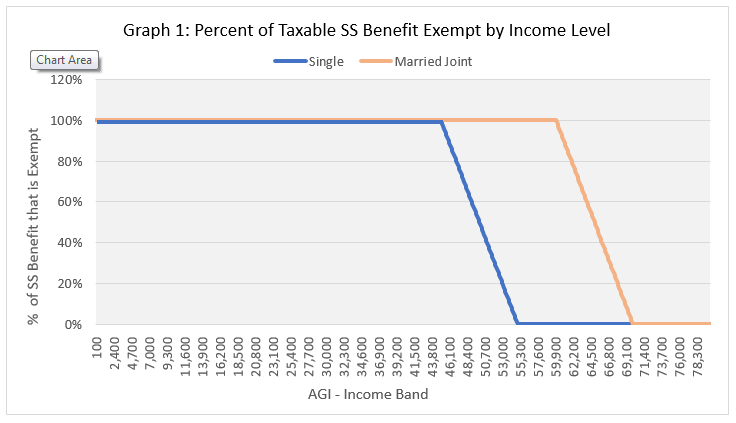

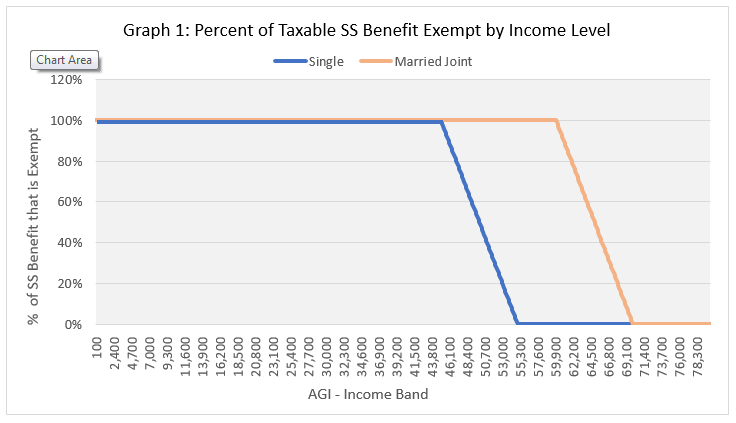

Social Security Exemption Department Of Taxes

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine

How To Update State Taxes In Total Planning Suite Desktop Edition Moneytree Software

State Budgets Are So Flush Even Vermont California Progressives Are Cutting Taxes

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

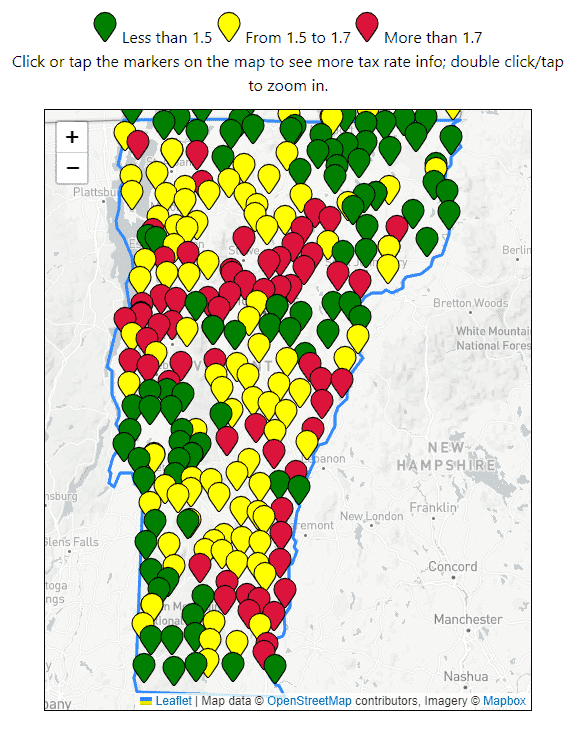

Vermont Education 2021 Property Tax Rates By Town On A Map

How The House Tax Proposal Would Affect Vermont Residents Federal Taxes Itep

Vermont State Tax Refund Vt Tax Brackets Taxact Blog

Vermont Property Tax Rates Nancy Jenkins Real Estate

States With The Highest Lowest Tax Rates